virginia estimated tax payments safe harbor

Pam Owens has an interior design practice set up as a sole proprietorship. The following definitions apply only to the computation of the addition to the tax for failure to pay estimated tax.

You must make quarterly estimated tax payments if your estimated tax liability your estimated tax reduced by any state tax withheld from your income is at least 600 unless that liability is less than ten percent of your estimated tax.

. Schedule 2 Form 1040 or 1040-SR lines 4 6 additional. The tax system is a pay-as-you-go system. Virginia does not have this leniency clause so the.

Estimated Tax Penalty Example. Generally the required annual payment equals the lesser of 100 of the tax liability shown on the return for the current year or 100. Estimated tax payments are made quarterly during the year starting on April 15th.

The 2017 Tax Act PL. If you pay either a 90 of your current years tax obligation b 100 of the prior years tax you wont owe any penalty. Virginia Estimated Tax Payments Safe Harbor.

Tax Account form to adjust the estimated accounts. Before the 1st day of the 4th month of the taxable year. The estimated safe harbor rule has three parts.

You also have to pay estimated tax if the amount being withheld is not sufficient to meet your tax obligation. If you did underwithhold both the IRS and Virginia apply a penalty based on the amount by which you underwithheld. Make a Payment Bills Pay bills or set up a payment plan for all individual and business taxes Individual Taxes Make tax due estimated tax and extension payments.

Virginia safe harbor As you had no tax liability in Virginia for tax year 2018 you are not required to pay estimated taxes for tax year 2019. If your Virginia income tax liability after subtracting income tax withheld and any allowable credits is expected to be more than 150 then you must make estimated tax payments or have additional income tax withheld throughout the year from your wages or other income. B an electing pte that filed the 510 published prior to june 29 2021 and only made.

If your adjusted gross income for the year is over 150000 then its 110. 115-97 reduced the US corporate income tax rate from 35 to 21 and repealed the alternative minimum tax AMT effective 1 January 2018 among other modificationsCorporations that generally pay first quarter estimated taxes based on last years tax for the first installment should consider whether using the annualized income. After the last day of the 3rd month and before the 1st day of the 6th month of the taxable year.

In fact this is one of the exceptions to the penalty for underpayment of estimated taxes. The IRS has safe harbor methods for calculating your estimated tax payments. SAFE HARBOR RULES For individual taxpayers required to make estimated tax payments the department will not impose the estimated underpayment penalty when.

Add the following other taxes from schedule 2 of 1040. Taxpayers who are required to make estimated tax payments but wait until late in the tax year to make a lump sum payment will be penalized for. However the IRS is generous enough to make an allowance for people like you and me.

With respect to any installment the underpayment is the excess of i the installment which would be required. If you pay 100 of your tax liability for the previous year via estimated quarterly tax payments youre safe. If you pay 100 of your tax liability for the previous year via estimated quarterly tax payments youre safe.

Regarding the safe harbor rule of paying estimated taxes of 110 of last years tax liability is last years tax liability FIT SS Tax Medicare Tax. 90 of the tax liability for the related tax return or. And if certain conditions are met your penalty is waived or reduced.

Here is the main part of the Safe Harbor Rule. The Following of the estimated tax shall be paid on or before the 15th day of the. Failure to pay estimated tax.

Careful consideration and analysis should be given to properly calculate state income tax projections and state estimated tax payments including exploring the existence of safe harbor rules eg. The 15th day of the 4th month of the taxable year. Thus there are two safe harbors for estimated tax payments.

This objective of the safe harbor provision - to provide a predictable escape from any possible penalty liability - would be defeated if penalties for underpayment of estimated taxes during the year were based not on the easily determinable amount reflected on the preceding years return but instead upon the ultimate tax liability possibly determined by adverse tax audit. 4th month 6th month. If your AGI was more than 150000 75000 if your filing status is married filing separately substitute 110 for 100.

The safe harbor estimated tax. The total timely estimated tax payments and credits are but not beyond the due date for the tax return. Contact BiggsKofford for Estimated Tax Payment Help.

Section 6655 of the Internal Revenue Code IRC generally requires corporations to make quarterly estimated tax payments of at least 25 of the required annual payment in order to avoid an underpayment penalty. Virginia safe harbor As you had no tax liability in Virginia for tax year 2018 you are not required to pay estimated taxes for tax year 2019. Start with line 14 on your 2019 1040.

Payments not made electronically will be subject to a penalty equal to 3 of the payment amount not to exceed 500. If your adjusted gross income for the year is over 150000 then you must pay at least 110 of last years taxes. In general you have to make estimated tax payments if you expect to owe 1000 or more when you file your return.

If youre estimating a down year so long as you pay within 90 of your actual liability for the current year youre safe. Farmers fishermen and merchant seamen with 2. If you follow these methods you wont be subject to additional interest and penalties even if you still owe tax when you file your return.

Estimated tax safe harbor. If you expect to owe less than 1000 after subtracting your withholding youre safe. If your adjusted gross income AGI was less than 150000 last year then youll need to make quarterly estimated payments that total the smaller of 100.

You cant just wait until April 15th and pay your tax bill. The IRS charges 2 on the amount by which you underwithheld but they have a leniency clause. Safe harbor can be applied to estimated taxes giving you some leeway in how much you need to pay.

If the amount by which you underwithheld was 1000 or less they dont apply any penalty. Estimated tax payment safe harbor details. The IRS says that for most taxpayers if your estimated tax payments equal at least 90 of the total that you ended up.

If you do youll owe penalties 14 to 1 of the amount owed for each month it is owed and interest at the rate of the federal short-term rate currently around 025- plus 3. Its complicated so Ill list the rules. 100 of the total tax liability shown your previous years tax return.

Understanding Individual Estimated Income Tax Payments And Safe Harbors Dermody Burke Brown Cpas Llc

Making Estimated Tax Payments Sc Associates

Don T Miss This Quarterly Tax Payment Deadline

What Happens If You Miss A Quarterly Estimated Tax Payment

Strategies For Minimizing Estimated Tax Payments

If You Got The Child Tax Credit In 2021 You May Pay In 2022 Wsj

What Happens If You Miss A Quarterly Estimated Tax Payment

Estimated Tax Payments And Retirement What You Need To Know Taxact Blog

Safe Harbor For Underpaying Estimated Tax H R Block

State Retirement Income Tax Retirement Income Military Retirement Benefits Income Tax

Self Employed Tax Calculator Independent Contractor Lili Banking

Safe Harbor For Underpaying Estimated Tax H R Block

Understanding Individual Estimated Income Tax Payments And Safe Harbors Dermody Burke Brown Cpas Llc

What Happens If You Miss A Quarterly Estimated Tax Payment

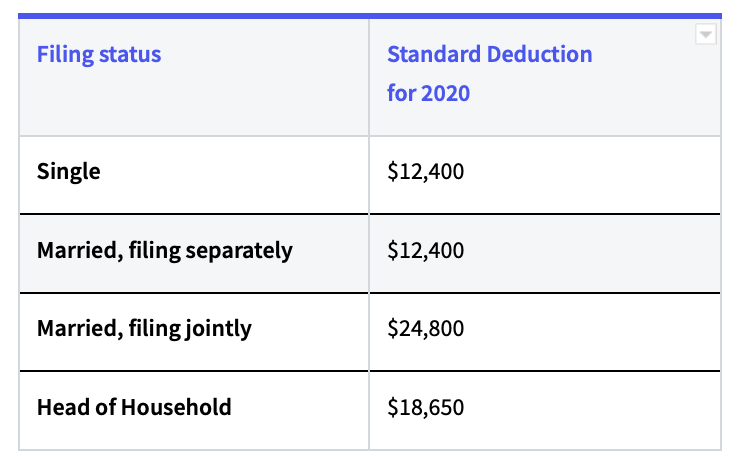

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

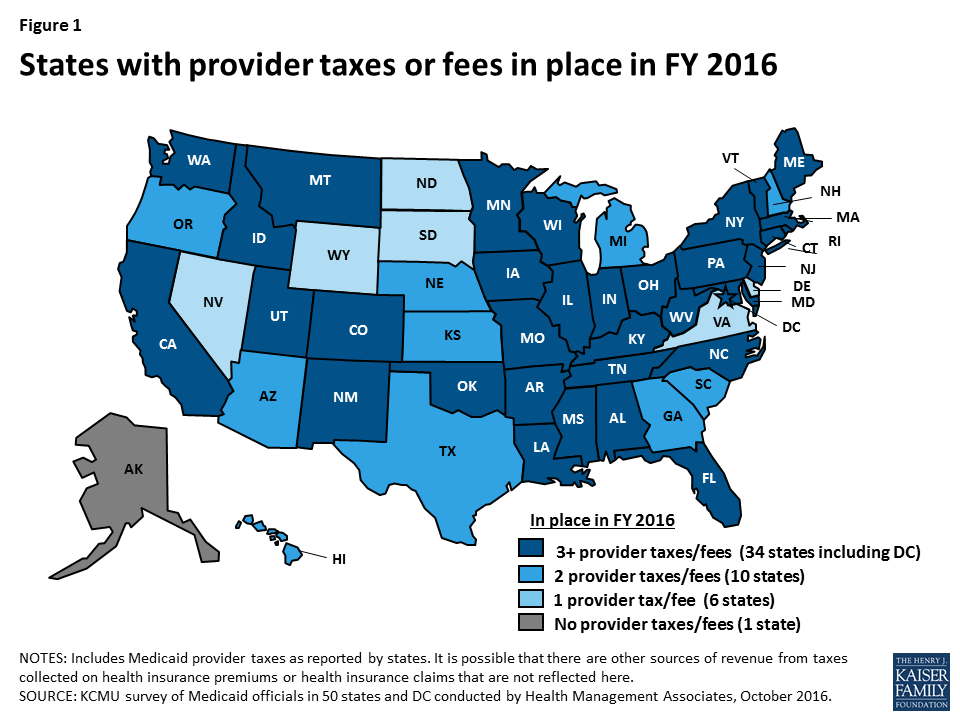

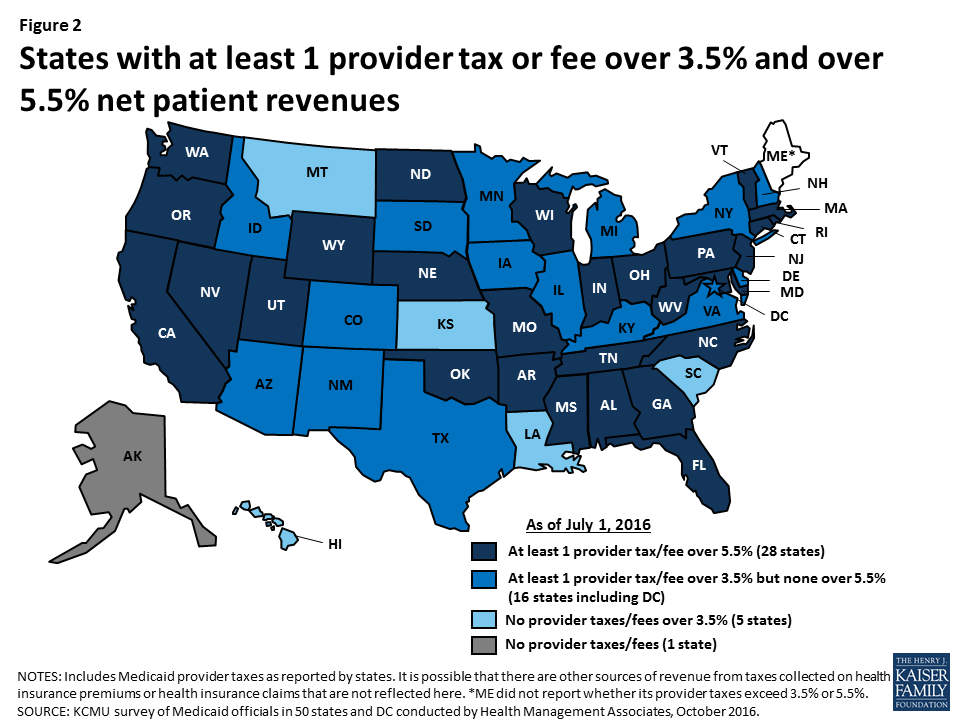

States And Medicaid Provider Taxes Or Fees Kff

States And Medicaid Provider Taxes Or Fees Kff

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Safe Harbor Requirements For Estimated Tax Payments Miller Consulting Group